Business rates on the best buildings in London are set to rocket to nearly two-thirds of rents in the next two years.

Business rates on the best buildings in London are set to rocket to nearly two-thirds of rents in the next two years.

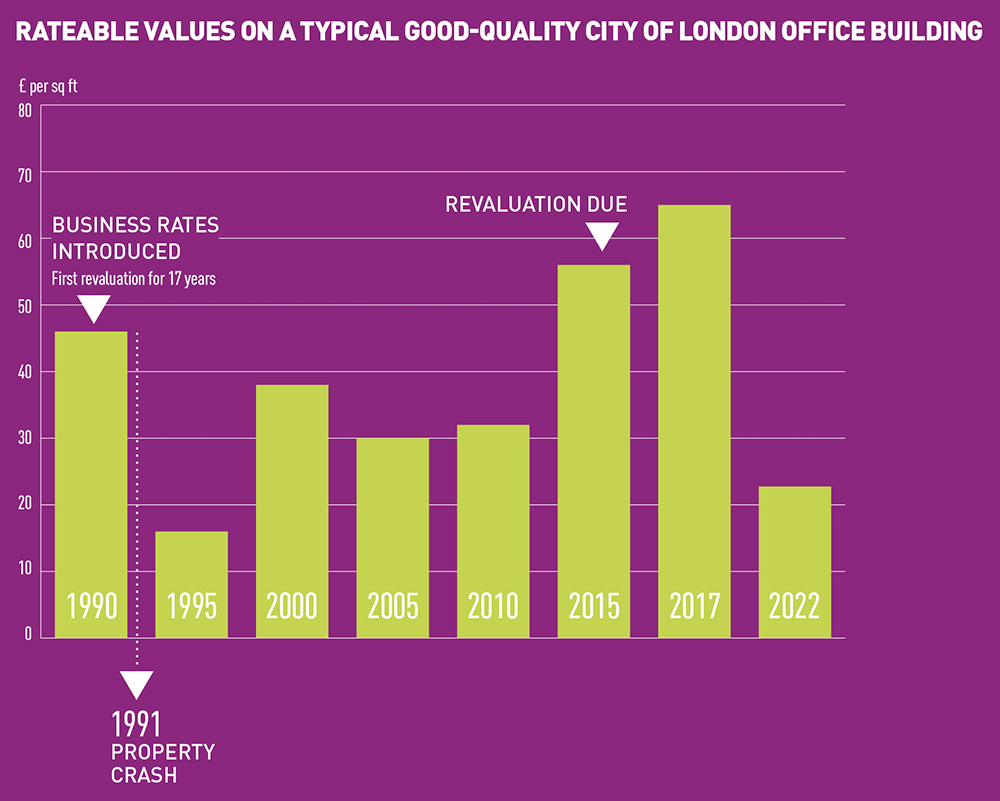

With the revaluation date just over a week away that will set rates increases in 2017, occupiers could be faced with a bill to pay their rents plus an extra 60% in rates against a current premium of 25%, according to figures compiled for EG by Colliers International.

For a typical, good-quality City office, this could amount to an extra £20 per sq ft.

The rise has been fuelled by London’s rental boom and the government’s decision to postpone a revaluation of business rates from its regular five-year period due to come into force this year to 2017. The decision to delay has meant that what would have been a gradual rise in rates will now end up being a spike in payments.

“When occupiers get their rates bill in 2017 they are going to look at it and say, ‘I can’t pay both rates and rents’, and it could lead to a property crash,” said John Webber, head of rating at Colliers.

The last time the industry saw an extended revaluation period was the 1990s when the current business rate system was introduced. Then City rents dropped by 65% in just five years with the revaluation in part to blame.

If a similar pattern was to be followed then City rents could be £24.50 per sq ft by the end of the decade, with the best London properties paying to make up for rental falls in regional markets.

Transitional relief or phasing may cap the rise at 20% a year. However, Webber warns: “This is not certain and I don’t think anyone would take a 20% increase as a win.”