For a lot of people – but clearly not the majority – last Friday was supposed to be just another day. Instead we were immediately faced with the prospect of prolonged uncertainty and, as reality set in, we began to ask ourselves question after question: how did it happen, what happens next, and will life ever be the same again?

For a lot of people – but clearly not the majority – last Friday was supposed to be just another day. Instead we were immediately faced with the prospect of prolonged uncertainty and, as reality set in, we began to ask ourselves question after question: how did it happen, what happens next, and will life ever be the same again?

To the last question, my answer is yes and no. Ultimately, the sky did not fall, and the sun rose the next day. Despite the mud, Glastonbury still rocked last weekend; England typically crashed out of the Euros on Monday; and Wimbledon returned to our screens in all its glory. The UK – and all that is great about it – must move on.

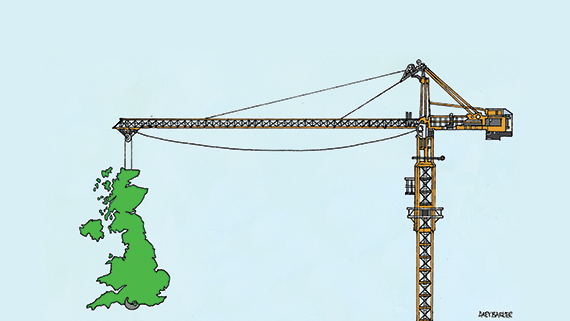

Property has to move on too – it always does. Despite the uncertainties, the attractiveness of real estate as an asset class continues, which applies to domestic and international investors. UK property and infrastructure markets are deep, liquid and transparent. Crucially, the sector offers secure income in a world characterised by low interest rates and quantitative easing.

True, we shouldn’t underestimate the depth of the change that may ensue over the coming months and years, but the weaker sterling will be seen as a positive for many overseas investors. Interest rates staying lower will also highlight the yield arbitrage that property offers on a relative basis. Occupiers will selectively review the relocation debate but will only be a small minority. Skills and expertise in London and its appeal as a place to live and work – not to mention our great regional cities – will not be turned upside down. World-leading culture, media, arts, sports, academia and science will not disappear.

While the referendum result will continue to be disruptive, a changed environment creates opportunity for those that are well capitalised, have vision and ambition. Adaptive behaviour will be rewarded.

The difference between winners and losers will be magnified. Winners will be investors with insight and creativity. Winning occupiers will be those of a high quality, either with a compelling and resilient strategy, or those who are fleet of foot. Winning cities will be grasping the opportunities offered by devolution to create better locations; intelligent positioning and progressive urban leadership will really count.

And what about the potential stimulus that could be offered by a refreshed and modernised regulatory framework, free from EU imposition? Perhaps it could lead to a more enlightened view of public private procurement, allowing policy to catch up with how development takes place on the ground, creating something much better, quicker and more predictable than OJEU. This will be good for regeneration, which could unleash the potential of the UK’s top 10 cities and provide an economic boost to the regions (perhaps appropriately, the very parts of the UK who voted to leave the EU in the first place).

Not everyone in business would have opted for the uncertainty that comes with the UK’s departure from the EU. But that was the outcome, and the associated disruption will create opportunities and threats in equal measure.

Bill Hughes, head of real assets, Legal & General