The UK’s only complete Grade I listed Georgian square – Portland Square in Bristol – has experienced a varied history, but a recent burst of activity has turned it into a development hotspot, aiming to return it to the vibrant area it once was for city dwellers.

The UK’s only complete Grade I listed Georgian square – Portland Square in Bristol – has experienced a varied history, but a recent burst of activity has turned it into a development hotspot, aiming to return it to the vibrant area it once was for city dwellers.

Built in the early 18th century for wealthy merchants in the then-booming city, the district where the square is located, St Paul’s, later fell into decline once its wealthy inhabitants had decamped to Bristol’s fashionable Clifton area following riots in 1831.

Throughout the 19th century the decline accelerated, isolating St Paul’s from the rest of the city’s continued economic growth. The area has long suffered from social problems including drug abuse, prostitution and poor housing, culminating in the riots of 1980.

During the 1980s and 1990s the square had become an edgy, predominantly commercial area.

“It was primarily commercially focused, so very quiet at night. As soon as people begin to live in the area it comes to life and is less prone to social problems,” says Chris Grazier, partner at Hartnell Taylor Cook.

With the success of Cabot Circus – Bristol’s premium shopping centre – just a short walk away and many of the square’s buildings lying vacant or in disrepair, Portland Square was ripe for redevelopment.

Located just outside the primary office area – on the “wrong” side of the M32 as it spills into the city centre – only around 40% of Portland Square’s offices were in use. The rest (around 100,000 sq ft) were either vacant or derelict. This situation was exacerbated by the economic downturn in 2007.

“There’s been an incredible amount of growth in the area. This regeneration has been trying to happen for a long time but it came to a standstill during the downturn. But it has now restarted with great momentum,” says Jay Ridsdale, director at Colliers International.

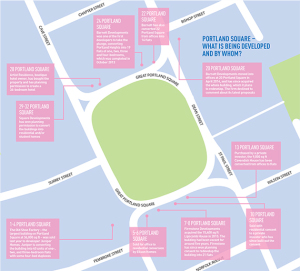

Today, and thanks in part to permitted development rights (PDR) – Bristol has the highest take-up of PDR after London – most of the buildings are at some stage in the residential development pipeline with some already converted and sold.

“When the opportunity came to purchase and develop 1-4 Portland Square we jumped at the chance. It is such a beautiful and historic square and used to be one of Bristol’s premier residential addresses. It feels like the perfect time for the square to re-welcome residents,” says Jon Morgan, director, Juniper Homes.

The remaining 33 units in The Old Shoe Factory (1-4 Portland Square) will be launched for sale in June – some have already been sold off-plan – with prices ranging from £194,950 to £400,000.

Over the next few years almost the entire square will have been redeveloped back into residential – with all the buildings retaining the original Georgian façades. Numbers 13, 17 and 25 – all separate buildings – have all recently obtained planning permission, too, Ridsdale says.

But not all will be residential. Plans have recently been submitted for a change of use for a new boutique hotel by Artist Residence at 28 Portland Square/2-8 Cave Street. Artist is expanding into the Bristol market and has hotels in London, Brighton and Cornwall. The 36-bedroom property in Portland Square is due for completion in 2017.

The renaissance of Portland Square is now also spreading into the surrounding streets. Barnett is to develop Portland View, which sits on the corner of Dean Street and Bishop Street, next to Portland Square. The scheme includes both new build and the conversion of two townhouses to create 31 flats, and is due for completion this autumn.

Plans have also been approved to convert the former Sandhu Cash & Carry on Surrey Street, which leads into the square, into residential or student homes. And Juniper has also recently submitted a planning application for a new development of 82 apartments on Dean Street, adjacent to Portland Square.

In February, Savills launched Cabot 24, a mix of one- and two-bed apartments developed by Places for People, near the square. Building work is expected to be completed by June.

“The change is about taking empty and under-used buildings and making them fit for purpose in a city that is desperately short of housing,” says George Cardale, UK head of residential, Savills.

With St Paul’s being listed as a conservation area, developers are having to deal with tighter planning controls making sure whatever is built is sustainable and fitting for the area.

Part of the draw of St Paul’s is its alternative identity and history, as well as its proximity to the city centre – all of which are finally proving a boon to the property market.

Student accommodation develops at the Bristol Royal Infirmary

The growing attraction of St Paul’s has also been driven by a thriving city centre thanks in part to the development of much-needed centrally located student accommodation.

The growing attraction of St Paul’s has also been driven by a thriving city centre thanks in part to the development of much-needed centrally located student accommodation.

Previously students mainly lived in the north of the city, but there are plans afoot for the former Bristol Royal Infirmary to be converted into 750 student beds.

In the biggest student accommodation development sale for some time, developer Unite bought the former BRI on Upper Maudlin Street – a short walk from St Paul’s – last year from the NHS Trust and is planning an £80m development on the site. Construction work is due to start in August with the first students moving in by September 2018.

Unite proposes to retain and reuse the original main hospital building to accommodate a new headquarters for itself and its 250 staff, together with a medical school facility, a lecture theatre, seminar rooms and clinical teaching space.

At the back of the site, the existing chapel will also be retained but the rest of the buildings will be demolished to create the new student development arranged around a landscaped central courtyard.

The accommodation will provide cluster flats of between seven and 10 beds with kitchen and lounge facilities – 8% of the accommodation will also be self contained studios.