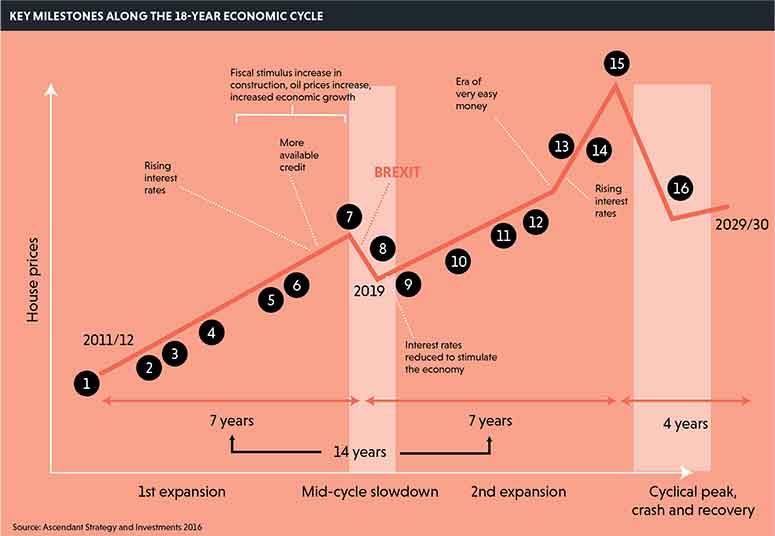

The next recession will be in 2019, and the next major downturn will be in 2026, according to the 18-year cycle theory.

Akhil Patel, head of research at residential development financier Urban Exposure, says that since 1800 recognisable recessions have occurred every 18 years in the UK and US, and this time around will be no different, with property at the forefront.

“It’s based on a long-term repeating cycle that has been in operation in the UK and the US since about 1800, where economies experience 14 years of expansion, and four years of economic recession,” he said.

“It’s most visibly seen in the property market, where you get relatively stable growth in house prices, leading to quite a significant boom, leading to a bust.

“Of course it is possible that this time around it will be different, but it would be the first time in 200 years.

“Since 2011-12, despite the fact that it’s a more globalised economy, things have been moving in a way fundamentally consistent to the way they have moved in previous cycles.”

1. 2011-12 The bottom of the market and the beginning of the current cycle. Falling property prices bottom out and economic growth begins.

2. 2013 Confidence returns slowly but concerns remain – for instance, fears of a triple-dip recession. However, a lot of buyers are back in the market and able to access mortgages.

3. Growth is concentrated in London. Bank lending remains conservative and people remain worried about the behaviours that started the previous mess. This keeps a lid on excess.

4. 2015-16 A steady recovery, with regional expansion.

5. 2017 Lending across the economy is expanding. A good indicator of widening credit markets is that when interest rates do rise they bring more players into the market – challenger banks – that keep costs low.

6. Government starts talking actively about fiscal stimulus, which contributes to a construction boom.

7. 2019 The end of that first phase and a pause in the market. Expanding economic activity leads to inflation. Governments raise interest rates, which risks tipping economies back into recession. External causes include a global construction boom and increasing oil prices.

8. A minor recession arrives, coinciding with the UK leaving the EU. The slump may be exacerbated by Brexit, but is not caused by it.

9. 2020 The proper boom. Looser monetary policy sets the stage for the next half of the cycle. Interest rates are low.

10. 2021-23 A huge amount of expenditure on public works and infrastructure takes place, with much easier bank lending.

11. More available credit pushes economic growth up. Infrastructure demand lifts commodity prices.

12. The FTSE 100 passes 10,000.

13. 2023-24 The big spike – the era of very easy money. Banks looking for opportunities to lend.

14. Plans for the world’s tallest building are announced, combining the optimism of a bull market and runaway land values. The business case, financing and construction all start prior to the peak of the cycle, but complete in the middle of the recession.

15. 2023-24 Inflation starts to rise. Governments raise interest rates, and at some point the market can no longer bear the strain. A trigger event or series of events occurs. Everyone heads for the exit at the same time.

16. 2026 Recession, austerity…

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette

Picture by: Alexandros Vlachos / Epa/REX/Shutterstock