Colliers International certainly won big with its purchase of H2SO last year, and has doubled its West End market share. Mergers and acquisitions are the hot topic of the moment, but can you buy your way to the top of the league table? Nadia Elghamry reports

A bottle of wine and a nice dinner, that’s how these things often start, and suddenly you are talking of merging your assets, grouping your strengths and spending the rest of your life together. No this is not a budding romance, well, maybe, but only of the corporate kind.

A bottle of wine and a nice dinner, that’s how these things often start, and suddenly you are talking of merging your assets, grouping your strengths and spending the rest of your life together. No this is not a budding romance, well, maybe, but only of the corporate kind.

Mergers and acquisitions were always going to be a big theme this year and one that for London started to come through in 2014. But only now are deals such as Colliers International’s takeover of H2SO starting to actually show through, shaping the agency landscape and those all-important league tables. The question for others eyeing a new romance, like DTZ and Cushman & Wakefield, is does gobbling up market share work? Can you buy your way to the top spot? And when the handcuffs come off do the wheels come off as well?

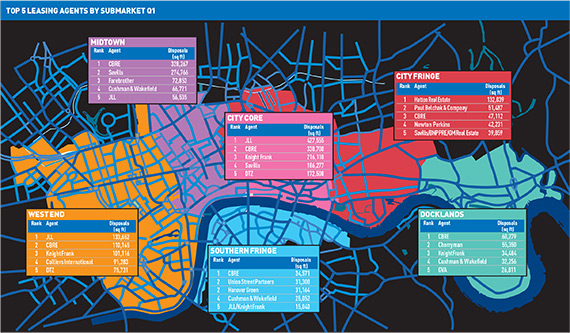

If, as reported, DTZ finds the cash for a $2bn (£1.3bn) bid for Cushman & Wakefield, its combined London leasing would top 662,000 sq ft, giving it nearly a fifth of the market. That would not be enough to topple the two US giants at the top of the table but, with less than a third of a per cent in it, it would make JLL incredibly uncomfortable.

CBRE, with 27% of the market share might feel better, but as others have proven, it is not always about just adding the sums together. Colliers bought H2SO in June last year; this is the first league table to calculate their combined strength. In the West End, where the merger of the two would really have taken hold, Colliers now commands a respectable 14% of the market. A year ago its combined strength with H2SO would have given it 7%. As Paul Smith, co-head of central London agency and development at Colliers, and former H2SO equity partner says with a smile: “Well, one and one really equals three.”

No one wants to make too much of one quarter’s league table, most of all Smith. The aim, he says, is to be a consistent top-five player. From failing to place in EG’s West End Q1 2014 top 10 to coming fourth this year, Colliers signed more deals than anyone else in the West End in quarter one, and came within 10,000 sq ft of overtaking Knight Frank. “With H2SO we never got the international feed, we just ate what we killed,” says Smith.

But those deals could become a little harder to pull off. The London office market is tighter than most can remember. Investment more than doubled in Q1 this year compared to last, dominated by the City core, and there were no deals in Docklands or Southern Fringe. Take-up of 2.8m sq ft in Q1 2015, while only a touch below the 2.9m sq ft transacted in the same period last year, was down by 29% on the last quarter. City core and fringe markets saw totals rise, the West End dipped, while the see-saw markets of Docklands and the Southern Fringe saw massive drops following several large deals in 2014 in Midtown, which has seen some of this quarter’s largest rental gains as take-up rose by a fifth in Q1 compared to last year.

“In the West End we never had prelets, or if we did, it happened in the last three months of construction. Now you are getting people early on in the cycle, when it is coming out of the ground, people with lease expiries in 2018,” adds Smith.

That has seen big rental gains in Mayfair/St James’s and Soho this quarter.

“Property generally is a long way down a businesses agenda, but we are now at the stage where property is being talked about in boardrooms. Transactions are limited and it becomes much more important for you to be on the end of those deals.”

Nobody seems to know that more than Savills. From a fairly consistent 12% market share last year, Savills this quarter bit into 15.5% of the total London market, helped in no small part by Deloitte’s 275,000 sq ft prelet of 1 New Street Square, EC4. That deal made up nearly half of the agent’s total, earning it a top-three position. “Inevitably as take-up declines because of limited supply, you will see more volatility in the league tables, says Philip Pearce, executive director of Savills’ London office. “The real objective is to stay in the top three,” he adds.

Top leasing deals of the quarter

| Company name | Address | Size sq ft | Letting agent |

|---|---|---|---|

| Deloitte | 1 New Street Square EC4A | 274,766 | CBRE/Savills |

| WeWork | Moor Place, 72 Fore Street EC2Y | 167,912 | CBRE/JLL |

| Hewlett Packard | Aldermanbury House, 1 Aldermanbury Square EC2V | 65,068 | DTZ/JLL |

| Investec | 30 Gresham Street EC2V | 61,190 | Savills/Knight Frank |

| Expedia.com | Angel Square, 405-415 City Road EC1V | 57,600 | Hatton Real Estate |

But unlike the past two cycles, there is not the plethora of sites ready to be built on, says Pearce. “Refurbs will have to step in, there is very little grey space and a limited supply of new development.”

In the City, despite construction starts this quarter outstripping the whole of either 2014 or 2013, the availability rate has barely budged since Q4 and is now at 7.1%, almost three-and-a-half percentage points below the five-year average.

And it could be about to get a lot more chronic. The central London market could be facing a black hole of office space in the next five years, according to JLL. Working with population forecasts and a typical staffing to floorspace ratio of 1:8, it calculates a 23m sq ft shortfall. Using ratios of 1:10 which are becoming common, that rises to 27m sq ft. If everything in London’s development pipeline is factored in, the net shortfall is close to 13m sq ft, says Michael Davis, head of JLL’s new London Unlimited team.

JLL launched the team just a week ago. Its aim is to tap into fringe areas such as Hackney, Deptford and Peckham. As such, Davis was always going to be an exponent of outer London, but says :“I have waxed lyrical about the war for talent and why people like Amazon move back into town, but to deliver space in that time we need land and larger schemes. You are looking at Silvertown, Stratford, Here East, Surrey Quays, Vauxhall,” he adds.

As central London supply dries up, could this be the next agency battlefield for deals and talent? “To be fair, there isn’t a vast amount of leading lights in this area,” says Davis, explaining the ethos behind building up the team rather than buying it in.

“We are not typical – you don’t have to be a real estate undergraduate to work for the team,” he says. Today there is a team of five. Next year Davis expects it to be 10. “History tends to show you that you buy and three years down the line the handcuffs are off and people go.”

Colliers has five years before the handcuffs come off for former H2SO partners, but when they do, and if the dealmakers leave, how will it affect deal performance?

In June last year Farebrother and Tuckerman’s South Bank joint venture, Union Street Partners, poached Simon Smith and Rupert Cowling from CBRE. Both joined CBRE via its takeover of EA Shaw back in 2012. You could argue it has hardly dented CBRE’s bull run. Drilling down to the Southern Fringe market and at first glance between Q4 2014 and Q1 this year, CBRE actually moved up the tables, taking the top spot in the submarket. However, its volume of deals slipped from 12 in Q4 to just two this quarter.

For Union Street Partners, hiring the pair meant it went from a sub-10% market share to controlling a quarter of the market, albeit in one big deal, letting 31,300 sq ft to One Avenue Group.

It is either too early, or too tricky to judge whether getting into bed with a competitor helps, but while the good times are rolling, the deals will keep coming in.

nadia.elghamry@estatesgazette.com

• See also LOMA Q1 2015: City starts on the up