From wait and see to abandon ship, the housing market is only going one way

House prices are set to fall in the coming months due to the huge economic uncertainty created by the EU referendum, although for many commentators it is too early to predict by how much.

The wider economic backdrop, political risk and mortgage availability will all have some impact, as will a wait-and-see approach among buyers.

Nationally, house prices are driven by economic performance and mortgage availability, according to Adam Challis, head of residential research at JLL.

Nationally, house prices are driven by economic performance and mortgage availability, according to Adam Challis, head of residential research at JLL.

“Whether we move into technical recession or not will impact on sentiment, as will employment figures,” he said. “Our central scenario is still being worked out, but you have to at least price in some material downward pressure on demand, and so price.”

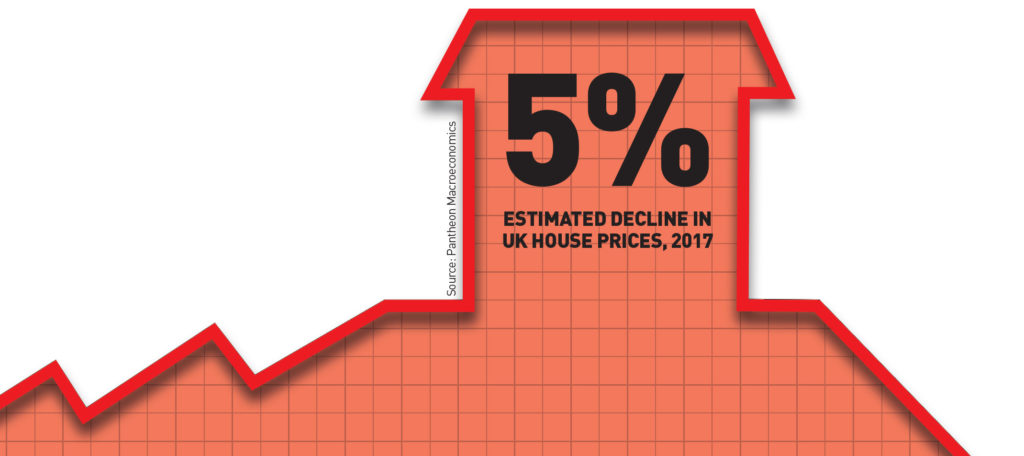

Samuel Tombs, chief economist at Pantheon Macroeconomics, said house prices could fall by 5% next year, in line with anticipated performance of the stock market.

Samuel Tombs, chief economist at Pantheon Macroeconomics, said house prices could fall by 5% next year, in line with anticipated performance of the stock market.

Alongside the economy, restrictions in the lending market will also have a big impact.

“If you understand the direction of the mortgage market, you understand house prices,” said Kallum Pickering, UK economist at Berenberg Bank.

“If you understand the direction of the mortgage market, you understand house prices,” said Kallum Pickering, UK economist at Berenberg Bank.

“Uncertainty and low confidence in outlook means less willing lenders and less willing borrowers, and lenders having a harder time pricing risk will only offer loans at higher interest rates to people who can definitely pay them back.

“A reduction in mortgage lending means, at the very best, softer growth in house prices, and at worst, a decline.”

Even a potential cut in interest rates to 0.25% is unlikely to stimulate lending.

“I do not think a significant ratcheting up of lending volumes is likely. You have to imagine a scenario where lending is more restricted than it is now,” said Challis. He added that lower interest rates would not be passed on to lending pricing, “which will have at least a moderate impact on [house] prices”.

How the government continues to support the housing market will also play a large part in determining future demand.

Help-to-Buy is well documented as supporting demand for housing around the UK. If the government continues to underpin mortgages, house prices will be protected.

Others said prices and sentiment were on a downward path anyway, and the forthcoming potential slide in prices was being camouflaged by Brexit uncertainty.

Walter Boettcher, director of research and forecasting at Colliers International, said that pre-vote, much of the market was looking shaky in terms of affordability, and post-referendum uncertainty had merely triggered these risks, adding to an existing adjustment.

Walter Boettcher, director of research and forecasting at Colliers International, said that pre-vote, much of the market was looking shaky in terms of affordability, and post-referendum uncertainty had merely triggered these risks, adding to an existing adjustment.

Despite the prevailing uncertainty, the general mood is that the situation will not be as desperate as in the last recession, and that banks and borrowers are better placed to weather a downturn.

“About 80% of housing transactions are reliant on a mortgage – that is what almost killed the housebuilders in 2008-09, the incredible constriction in mortgage activity. But we are not at the highs we were at,” said Anthony Codling, managing director at investment bank Jefferies.

Political certainty will do much to assuage fears, but that looks unlikely until at least November.

Follow our Brexit reaction blog here >>

• To send feedback, e-mail alex.peace@estategzette.com or tweet @egalexpeace or @estatesgazette