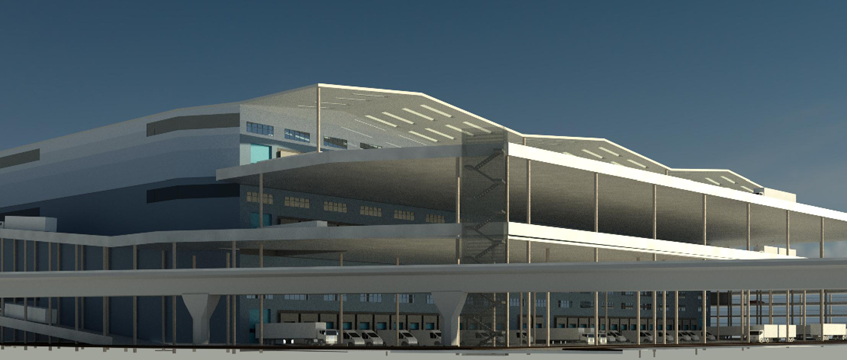

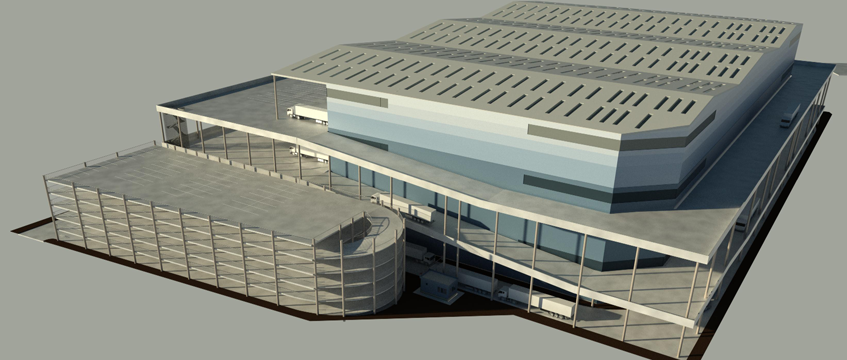

GLP-owned Gazeley is to build a 426,000 sq ft, three-storey warehouse in Peruvian Wharf, which will be the first of its kind in the UK.

The six-acre plot in Silvertown, east London which will be called G Park London Docklands, has been bought from Cain International and Galliard Homes and will be used as an inner city last-mile logistics hub for London.

Inner city rents have soared in recent years due to demand for last mile distribution centres from rapidly expanding online retailers. As a result it is thought that rents for what will be a cutting edge scheme could hit £20 per sq ft. Based upon a yield of 4.25%, now common for the highest quality logistics centres, this would reflect an end value of £200m.

It will be speculatively developed and available on a single and multiple occupancy basis. Subject to planning, the development is due to complete by the end of 2019.

Despite the development being the first three-storey facility in the UK, multi-storey developments are far more common in Asian markets where Gazeley owner GLP is dominant. Since GLP’s €2.4bn purchase of Gazeley in October last year, the company has been looking to push the boundaries of how a logistics owner integrates with its customers, looking at introducing methods used by GLP in Asia where it has a financing business for its customers’ core business initiatives and invests in telematics.

Nick Cook, chief executive, Gazeley, said: “Following the completion of the acquisition, our priority was to ensure that the expertise that Gazeley and GLP have built over their respective histories was effectively utilised. Multi-storey developments are more common place for GLP and we are delighted to be able to bring this concept to the UK.”

Alex Verbeek, managing director, UK, Gazeley, added: “This type of development has never been done before in the UK. A three-storey warehouse in such a central location will be hugely valuable for Londoners who will benefit from customers being able to deliver goods in record time.

“London is at the forefront of the digital revolution, but these services require an equally innovative supply chain to facilitate it. We feel that G Park London Docklands will make a big contribution to the infrastructure, which is essential to support London’s evolution as a leading centre for digital commerce.”

Cain International and Galliard bought the site at the beginning of 2016 from the late Cyril Dennis’s Capital & Provident and Nama with the intention to build a 946 flat residential scheme while retaining the active industrial wharf frontage.

However, the site fell victim to the GLA’s changing views on Strategic Industrial Land, as it cracked down on the loss of employment and distribution space in the capital to residential, despite previous indications from Newham Council and the GLA that residential development would be appropriate.

Due to the shortage of land available for inner city development the sector has been looking to new technology and development types in order to counter the problem – with higher potential rents making them possible.

In Hounslow, Formal Investments has received planning to develop a 2m sq ft shed underground. The sector is also paying historically high land prices and it is understood that Gazeley bought the land at Peruvian Wharf for a price higher than it had been underwritten at for residential use.

SEGRO and Turley warned last year that the loss of industrial land would result in the city grinding to a standstill as the population continued to increase. It said the GLA’s expected loss of industrial land by 2031 could have been reached already.

Around 2.5 acres of land still owned by Galliard and Cain International remains earmarked for residential use, and which the partners are looking to dispose of.

Levy Real Estate acted for the sellers.

To send feedback, e-mail david.hatcher@egi.co.uk or tweet @hatcherdavid or @estatesgazette