The amount of property owned by the biggest real estate investors continues to grow, with an increase of $900bn over last year in assets by value. Chinese companies have extended their influence and now hold four of the top five places.

The world’s top 100 real estate companies now own more than a whopping $5.5tn of assets, according to EG’s annual Global 100 list.

The list, based on publicly available assets under management figures, is now in its sixth year and has seen the value of the top 100 continue to grow. This year’s figure is some 20% higher than 2018’s.

Chinese real estate owners continue to dominate the top of the list, with Canadian giant Brookfield the only North American firm to make it into the top five.

Despite the dwindling number of North American real estate firms at the top of the list, the US region continues to dominate in terms of total portfolio size, with the 29 US firms in the list collectively owning portfolios valued at $1.7tn. The 19 Chinese firms together own $1.4tn. Together, the two countries reflect 57% of the total value of the top 100.

China’s Evergrande Real Estate is the biggest owner of real estate in our list for the second year. The Guangdong-based company secured its spot with a whopping $270bn of assets under management.

Combined, EG’s top 100 global investors’ assets total more than the GDPs of every country in the World Bank’s rankings except for the US and China ($19.4tn and £12.2tn respectively).

Sovereign funds in real estate: few but mighty

Sovereign wealth funds make up only a small proportion of the real estate investor universe – less than 3% at the end of 2018 – but they remain some of the largest and most influential institutions active in the asset class, writes Tom Carr, head of real estate at Preqin.

In fact, the largest real estate investors in Asia, Australasia, the Middle East and Africa are all sovereign wealth funds, demonstrating their influential position.

Abu Dhabi Investment Authority remains the largest sovereign wealth fund investor in real estate, with an allocation of more than $50bn. Of the four largest sovereign investors in real estate, two each are based in Singapore and the UAE, collectively allocating almost $150bn to the asset class.

The advantages of real estate investments for sovereign investors are clear: the asset class offers portfolio diversification, inflation hedging, long investment horizons and the potential for regular income. This aligns strongly with the priorities of many sovereign wealth funds, and helps explain why several have made direct acquisitions of landmark real estate assets.

But sovereign wealth funds also commonly commit to commingled vehicles, and often hold diverse portfolios. When they do make investments in commingled funds, their commitment sizes are larger on average than for any other investor type – $152m, compared with $50m among public pension funds, the next largest.

At a glance

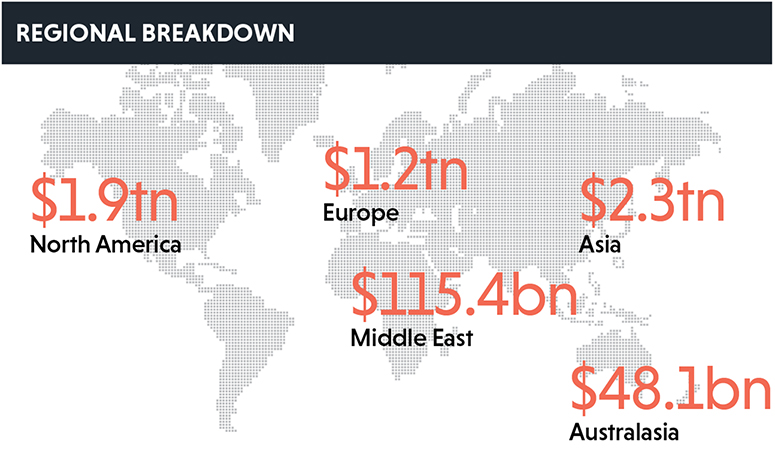

- 42% – The percentage of the total asset base of the Global 100 that is owned by Asian firms. Together, China, Hong Kong, Singapore and Japan-based firms own $2.3tn of real estate. The total means that Asian real estate companies collectively own a portfolio almost double the size of the European companies in the Global 100.

- $195.9bn – Total assets held by Brookfield, now the sole Canadian firm on the Global 100. It hangs on to second place behind China’s mighty Evergrande.

- 4/5 – Number of spaces in the top five taken up by Chinese firms.

- $55.5bn – Average value of real estate that the Global 100 firms own.

- 3 – The number of countries that are represented only once in the Global 100: Canada, Norway

and the UAE. - $1.2tn – Total value of real estate owned by European companies, with France leading the way with a combined portfolio value of $275.7bn, followed by Germany with $228.8bn and Switzerland with $211.3bn.

- $19.9bn – Minimum portfolio value that any company hoping to make the Global 100 would need this year.

To send feedback, e-mail samantha.mcclary@egi.co.uk or tweet @samanthamcclary or @estatesgazette