Central London’s prolonged and unfettered reign as the darling of global real estate investment has come to an end. For now.

In the aftermath of the global financial crisis it had mass appeal as a safe haven for international wealth and the place to live for domestic buyers.

But in the run-up to the Brexit deadline the main players are opportunist funds picking off small sites from developers in financial difficulty where plans or construction have stalled.

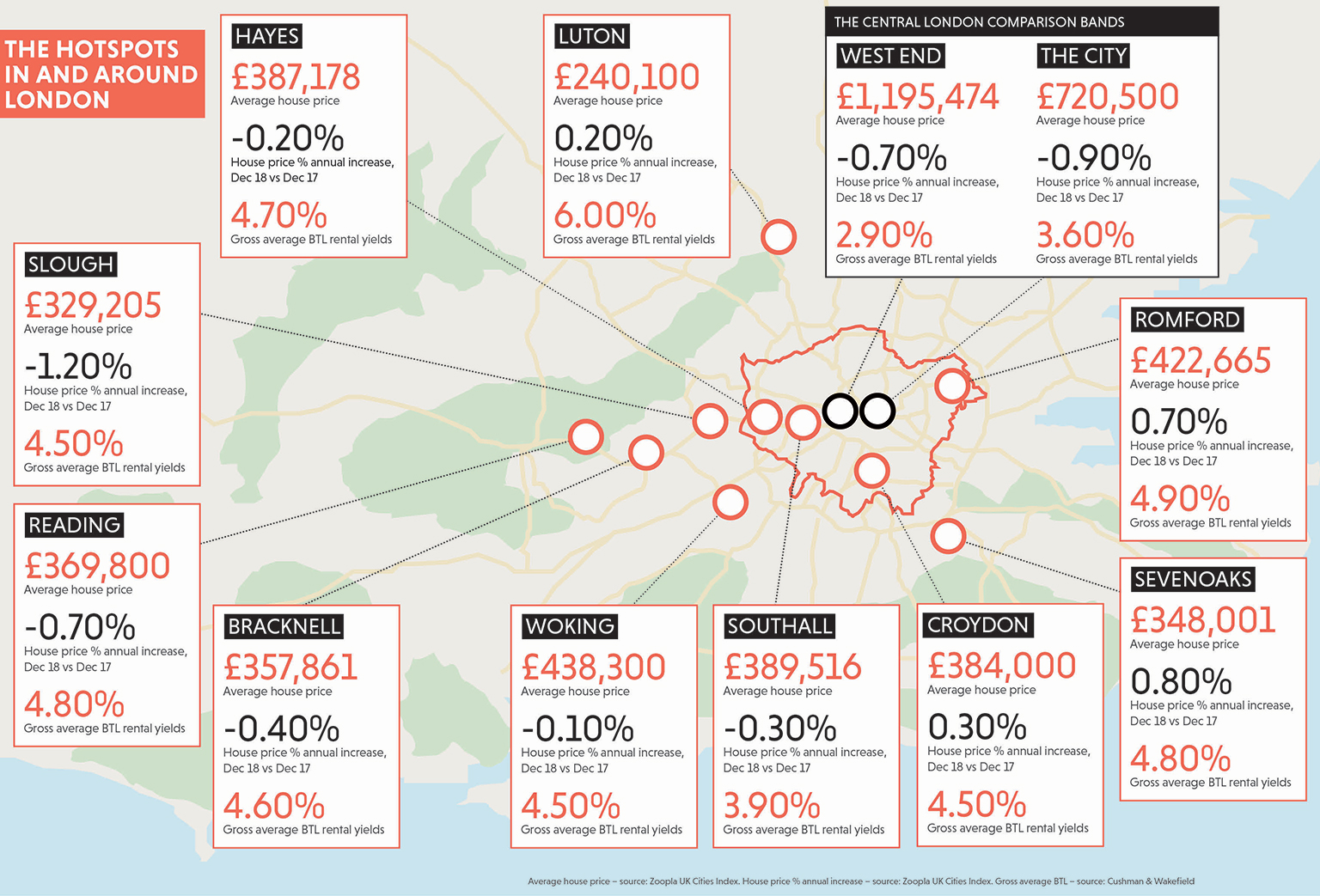

Meanwhile, in the mainstream market institutional investors, private buy-to-let landlords and owner-occupiers are scouring the city fringes and beyond for up-and-coming investment hotspots.

Investment indicators

The most compelling locations for capital appreciation and yield have direct access to London and its talent pool, new or due transport infrastructure and a town upgrade on the way.

Crossrail took the baton from the Olympic Park-led regeneration of east London as the investment story of the past decade in the UK, and is still running with it.

The £15bn high-speed railway (the Elizabeth line) will stop at 41 destinations from Reading in Berkshire through central London to Shenfield in Essex and has driven the transformation of urban centres such as Woking in Surrey and Tottenham Court Road, W1T.

The investment arc for a project such as Crossrail starts long before the tunnelling machines appear. Early land speculators wade in when plans are first approved (flipping to housebuilders), serial property investors buy off-plan and sell on, and those homeowners who wanted to benefit from house price inflation have long moved in.

The final investment phase is still to come. Each location will see an influx of renters when the service finally runs (now due in autumn 2019) as this property tribe does not benefit from living near the Elizabeth line before it launches. Demand will therefore drive up rents for landlords at that point.

Another investment indicator is a “forward-thinking town council” that has upgraded retail and leisure around transport hubs, says Cushman Wakefield’s Chris Lewis. He cites Reading and Bracknell. “These towns give you a welcome when you step off the train,” he says.

The arrival of big occupiers suggests Reading is still a safe bet for investment as its talent pool expands and workers choose to live there, generating more trade for local businesses. The average office rent is £38.50 per sq ft compared with £67.50 in the City and £110 in the West End. Virgin Media has committed to 120,000 sq ft in the Thames Valley town.

Lewis’s pick of the M4 corridor, however, is Slough. “It has great connectivity already and will benefit from Crossrail but the town centre and retail offering have some way to go,” making it ripe for attention.

So, which other fringe towns are making their own case for investment?

The London spread

Although all investor tribes – from housebuilder to office occupier to homeowner and tenant – are looking beyond the capital for yields and house price growth, the preferred locations are still reliant on London. “The next wave of investment in the South East is still headed for places within the sphere of the influence of London,” says Nick Whitten, director – UK research at JLL.

Lewis agrees: “London is the engine room of UK commerce, with the highest quality of workforce, but it has just got expensive, pushing commercial and residential property investment into the fringe towns, in turn driving regeneration across the South East.”

Romford

Buy-to-let yield: 4.9%

The combination of Crossrail and constrained housing supply has driven up house prices in Romford, in the London borough of Havering. It is surrounded by green belt land and, despite the flow of young families coming out of London, its construction pipeline is dominated by one‑and two-bedroom flats.

“New build here is geared towards the first-time buyer and investor,” explains Andy Redman of Savills.

“The retail mix is not right in the town either,” he says. “There are retail investors worried about the high street who are building homes on top of units to spread their risk. The next wave of investment in Romford needs to be a retail upgrade and leisure facilities.”

And it’s coming. The mixed-use Bridge Close scheme will deliver 1,000 homes, commercial space, a new primary school and will open up the river path, giving direct access to the nearby Crossrail station. A £25m funding package is being ploughed into the new Sapphire Ice and Leisure development – part of the council’s masterplan.

Barry Jessop, director of developer First Base, says: “Romford is a major market town in its own right and is reported to be the fourth-largest retail centre in London. It has a very good catchment, a natural footfall and a high level of surrounding wealth, but the town centre and retail offer have been neglected. With such strong demographics, along with a revitalised town centre and the arrival of Crossrail, we expect to see high levels of growth.”

Change is due to sweep across the north of Essex following a proposal for three garden communities, which will deliver 43,000 homes.

Sevenoaks

Buy-to-let yield: 4.8%

The most popular destination for people moving out of London is Sevenoaks in Kent, according to recent data from Hamptons International. This has not escaped the attention of developers. Crest Nicholson closed its central London office last year and has opened one in Sevenoaks. One consultant told EG that a handful of major national housebuilders are focusing on Kent.

The county is also set to benefit from the biggest road infrastructure project since the M25 was carved around Greater London. The 14.5-mile, three-lane dual Lower Thames Crossing will connect the M2 at Rochester and the M25 in Essex between North and South Ockendon and includes a 2.4-mile tunnel between Gravesend and Tilbury. It is expected to halve the journey time northbound along the Dartford Crossing and ease congestion across the whole of the easterly commuter belt.

“The Lower Thames Crossing will bring more housing supply as plans are for new homes to track the route,” says Redman. The proposal is out for public consultation.

“Kent is cheaper than some of the other Home Counties such as Surrey or Hertfordshire and has a good mix of affordability, access to London and choice of schools,” says Nick Whitten, director – UK research at JLL.

Berkeley Homes has a few apartments remaining in its Ryewood development by the Sevenoaks Wildlife Reserve. Prices start from £279,995 and help to buy is available.

Southall

Buy-to-let yield: 3.9%

Southall in the borough of Ealing is one of the few untapped locations in London with a considerable regeneration journey to come. It has a clapped-out shopping centre and some local shops but it’s the supply of land (old utility sites) and the imminent arrival of Crossrail that has piqued investor interest.

Once the Elizabeth line is running through the Southall Crossrail interchange it will take only eight minutes to get to Heathrow, 13 to Paddington and 24 to Liverpool Street.

Southall is currently cheaper than neighbouring areas Brentford, Greenford and Heston and has been predicted by Rightmove to become one of the highest price-growth areas in London as the vast Ealing regeneration spreads.

There’s a ready-made employment market, says property consultant Jack Ballantine. “Aside from Crossrail, the Heathrow expansion is set to create 40,000 jobs locally. There are also a number of leading hospitals in the area that provide for an already strong workforce.”

The first developers are breaking ground and over the next three years locals will see 3,500 homes springing up from developers Strawberry Star, Redrow and Berkeley Group, to be built alongside the existing Victorian terraced houses.

“Southall is on the cusp of change,” Ballantine adds.

Luton

Buy-to-let yield: 6%

Luton in Bedfordshire ranks as the best commuter destination in and around Greater London by efficiency of train service combined with reasonably priced housing – the average property price is £253,988.

The Luton Investment Framework has sunk £1.5bn into regenerating the town centre with the delivery of hundreds of new homes, shops and restaurants, creating 18,500 new jobs over the next 20 years. The airport is expanding and house prices have risen 22% since 2015.

Nick Leeming, chairman of estate agent Jackson-Stops, believes Luton will continue to outperform London: “With the Bedfordshire town benefiting from significant inward investment over the next 20 years, we expect Luton to continue being a key spot for commuters, and investors alike,” he says.

LU2ON by Strawberry Star Homes is a new 6.8-acre development on the former site of the Vauxhall Motors factory. It will deliver 785 studios, one- and two-bedroom apartments, with private roof gardens and a 24-hour concierge service. Phase one (400 flats) is due to be completed in 2021.

Croydon

Buy-to-let yield: 4.5%

Recent research from estate agent Portico has named Croydon as one of the top 10 investment hotspots within Greater London. This message is echoed in the local plan, which dubs Croydon London’s growth borough. It has the fastest-growing tech cluster in the capital and 10,500 homes in the pipeline.

Croydon is undergoing a £5.25bn regeneration plan led by developer Boxpark. New-build schemes include Saffron Tower and Surrey House and the refurbishment of the historic Nestlé Tower into 290 flats. The new Westfield shopping centre will increase its appeal and construction, leisure and new occupiers should create 23,000 new jobs over the next five years.

It’s also well connected – the train takes 14 minutes to Gatwick Airport and 17 minutes to London Bridge.

Hayes

Buy-to-let yield: 4.7%

Hayes in west London is benefiting from the build-to-rent boom on the outskirts of the city. Residential developer HUB has just completed the 189-unit Material Store with 26 triplex apartments.

It’s part of the wider industrial-to-residential conversion of the old Vinyl Factory, is a short walk to Hayes and Harlington Crossrail station and has a children’s playground, party rooms and communal terraces.

Crest Nicholson has started the groundworks for its new 88-home site, while Bellway Homes has submitted planning for 118 new residential units and commercial space.

“Tenant appetite for the rental apartments remains strong, both for residents moving locally and also those looking for better-value accommodation with quick links into the city. These will of course only improve once Crossrail is completed,” says a spokesman for developer EcoWorld.