Exempting speculatively built warehouses from business rates until they have tenants, could be one solution to the critical industrial space shortage, according to law firm Addleshaw Goddard.

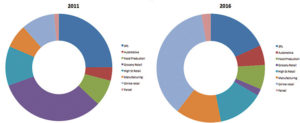

Industrial space is suffering a “critical” lack of stock, driven by the surge in online retail and the necessity for space to hold online and retail deliveries.

Lee Sheldon, head of real estate at Addleshaw Goddard, said: “There is not enough capacity on our roads to deliver everything, nor enough space in our cities presently for the urban logistics warehouses needed to house items. Put simply, if we want to carry on shopping online and having next day deliveries without paying massive premiums, far more needs to be done to unlock land for industrial use.”

Colliers International has estimated that 18m sq ft of new industrial space – equivalent to 251 Wembley Stadiums – will need to be built annually to satisfy the UK’s exponential e-commerce growth and demand from parcel firms. However according to Savills, only 3.8 million sq ft of space will be delivered this year, with only 26.4 million sq ft of stock available.

Research by Prologis and Aberdeen Asset Management in 2015 estimated that an additional 775,000 sq ft of shed space is needed for every extra €1bn spent online.

Official data by the Centre for Retail Research, found online sales made up 14.6% of UK retail in January this year, with e-commerce projected to have a 21.5% share by the end of the decade.

Kevin Mofid, director of research at Savills, said: “With the memory of the global financial crisis still fresh in the minds of many developers, investors and bankers, the delivery of warehouses on a speculative basis has not been sufficient to keep up with demand. In turn this has driven occupiers to take an increasing proportion of build to suit units. The knock on impact for occupiers will be that rents and lease terms will increase as developers need this commitment to bring schemes forward.”

Addleshaw Goddard has published a report – How soon is now?, which tackles the evolution of the logistics sector, its impact on the property industry, and makes a series of policy recommendations on how to unlock space for industrial use. If no action is taken, the cost could be transferred to the consumer.

The proposals in the report include:

Not levying business rates on speculatively built warehouses until they are occupied

This would encourage more investment, leading ultimately to higher tax revenues occurring more quickly. The charging of business rates on empty properties is a disincentive to speculative development of industrial and logistics property. Some local authorities delay entering speculatively built properties into the national rating list until the building has been occupied, removing the empty rate risk and making development more likely. The report states the Government should set national guidelines for this rather than just leaving the choice up to local councils.

Encouraging councils to designate and bring forward public land for industrial use

The new housing and planning minister should encourage local authorities to prioritise properly thought through employment policies. Housing policy trumps employment policy within local planning, which is not necessarily always the best priority. There should be far greater curation of uses, and this must be intertwined with greater clarity at a national level.

The report states we should also consider which different types of industrial sites are now needed. The changing nature of the economy means the built environment also has to change. How we resolve this will take careful consideration. But, crucially, we must recognise that if consumers want products within 24 hours, 60 minutes or virtually instantly, then infrastructure, real estate and transport will have to support this.

Government should look to directly support development by SMES

Many sites that could potentially support industrial development are unlikely to be unlocked because of the lack of infrastructure – such as roads, power or sewerage – and the prohibitively high cost of providing it. The Regional Development Agencies (RDA), abolished in 2012, were an important source of funding for infrastructure. They bridged the gaps between local authorities, an important way of recognising that infrastructure spending often benefits adjoining council areas. The financial power available now to Local Enterprise Partnerships is very limited compared to that of the RDA’s. The Government needs to consider a greater role for the Homes and Communities Agency, which has £4.7bn of grant funding available for affordable housing, to kick-start industrial development with a similar kind of budget for land assembly, remediation (cleaning up sites) and above all, installing vital infrastructure that could offer many broader benefits to both employment and housing deliver

John Clements, development director of Verdion, developers of the multimodal iPort logistics park near Doncaster, added: “The e-commerce revolution has given industrial a much higher profile as an asset. With long leases on high quality buildings backed by strong covenants and rental growth through indexation, the returns in the logistics sector are far more interesting than many other asset classes currently, so it’s a very appealing sector for investors.”

To send feedback, e-mail amber.rolt@egi.co.uk or tweet @AmberRoltEG or @estatesgazette