Four years after ABP emerged as the frontrunner to transform London’s Royal Albert Dock, E16, the land has finally been released by the Greater London Authority to the Chinese company for development.

Since 2013 there have been setbacks, new financing arrangements, trade delegations to and from China, scepticism, government intervention – from both sides – photo shoots, investigations and promises. Now, the developer has stumped up the cash and is getting to work.

Given the time that has elapsed, cynics in the market have wondered if the development would ever happen. The rigmarole could also be seen as telling of the confidence UK plc has in Chinese investment.

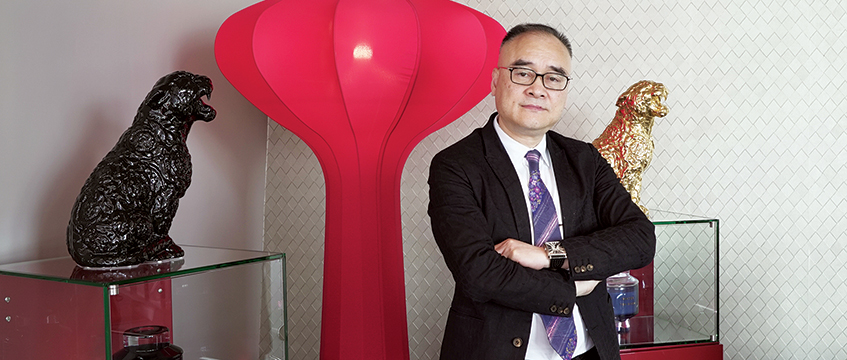

The normally ebullient chief executive, Xu Weiping, keeps things brief when asked what the most significant milestone has been at the development.

“The land drawdown,” he says. “This is the most important thing for the project. Because it is not easy to establish these relationships of trust with the UK government, I think the land drawdown means the recognition by the UK government of ABP.”

Xu sits comfortably in his enormous office in the 1000 Building on the north side of the dock. ABP has the top floor, Newham Council is downstairs.

Ornaments decorate the room, including a large dragon in the lounge and a brass tea set. There is also a Star Wars comic and an industrial-themed Sellotape holder.

Xu is smiling and says he is going to take the rest of the day off.

“In the past four years, from signing the development agreement, to getting all the pending approvals, to procurement, to the land drawdown… This is very important for the project and that is the thing that makes me the most happy.”

The normally flamboyant frontman seems at first sombre in a tailored black suit and white shirt. But on closer inspection the suit has a snakeskin print on the fabric; the shirt a huge tiger embroidered on one side.

Outside, the sun is blazing as contractors from Multiplex bore into the 35-acre site, looking for bombs.

Albert Dock was hit hard in the second world war by the Luftwaffe, though it was the UK’s post-industrial decline that finally led to its closure in 1981.

Since then it has sat vacant, unable to attract the development seen at Canary Wharf, North Greenwich and now even Victoria Dock, further to the west.

It has been a long road for the dock, and for ABP, which has had to jump through a lot of hoops to get this far.

Lead contractor

Multiplex workers are joined by those from CITIC Construction, lead contractor on the site. They have only just been able to get going in the past few months.

The scheme is a UK first for the construction arm of the enormous Chinese conglomerate.

For the moment, the CITIC presence is limited. It has a handful of people, against Multiplex’s four dozen. The conglomerate’s financial presence, while invisible, is far more important.

Backed in part by the Chinese government, it took equity in the site back in 2015, to the tune of £100m, effectively kickstarting the funding process.

“CITIC has been playing an important role in the development,” says Xu, who explains it is active in the build out: monitoring quality, site control and the management of subcontractors.

“At the end of last year they helped ABP set up a funding platform and secure funding from the five major banks of China.”

Those five – CITIC Bank, Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China and China Construction Bank Corporation – are providing development finance for the £1.7bn build out.

Other equity holders include Thailand’s Charoen Pokphand Group, which signed a deal at the end of 2016 to provide a further £425m in equity, and residential developers Strawberry Star.

That money was important in unlocking the land, says Xu.

A change in London mayor did lead to Sadiq Khan looking into the site, as happened with other public land disposals under the previous administration, though in the end nothing was changed.

“When they had a new team at the GLA,” says Xu, “they had done a study on the project internally, but their support for the project remained the same.

“That is because when we do procurement, when we do a planning application, we fit in with the UK law and regulations closely, so everything is done properly. Which means they do not need to change anything. That also means they are still supportive of the project, and also of the later phases.”

To add to the security of the development, the Chinese government will also be guaranteeing the money through its state insurance company, Sinosure, which backs overseas investment.

“It is a Chinese credit export organisation, state owned, and has given us full guarantee of the funding coming to the UK from China,” says Xu.

The company, also known as the China Export & Credit Insurance Corporation, is, according to its website, “a state-funded policy-oriented insurance company with independent status of legal person, established for promoting China’s foreign trade and economic co-operation”.

“The Chinese government has been very supportive of the project, both the central government and the Chinese embassy in the UK,” says Xu.

It was the proof of funds, alongside detailed planning and a business plan, that finally warranted the GLA handing over the land.

All of which shows the level of scrutiny – and perhaps lack of faith – the UK government has had in the viability of the development. This could be seen as rich, considering the list of bidders for the site when it was put up for sale, as revealed in a London Assembly investigation.

“This wasn’t a site that everyone was rushing for. There was very little interest – that was part of the problem,” said then deputy mayor Edward Lister.

But all of that is water under the bridge. Xu says buildings should start coming out the ground later this year.

Speeding up construction

Phase one will span five buildings, while the total plan is for about 40. Phases two and three will follow soon after. ABP wants to speed up construction.

Xu is hoping that phase two will start before phase one is completed. He sees the residential included in later phases as important for the development of the site.

Occupiers are the next task. The Chinese government has already said it will help encourage tenants to relocate from mainland China. Now, Xu is relatively coy about who will take the space – and it seems each year brings new and contradictory announcements. But with construction starting, he will want to secure prelets.

“We have quite a lot of intending tenants, but we need to make some selection. The best time to select our first occupiers will be the second half of this year, after construction begins, and the first half of next year.”

Pre-sales will also be on the agenda, as ABP does not intend to keep the entire site. Xu says it intends to sell about 60% of the building to owner-occupiers, and retain a further 40% for leasing.

“We are still looking for new investors,” he says, “but we put the value and influence of the investors as top priority. We want to have investors that can have a positive impact on UK and China trade relations, not just purely financial investors.”

Inevitably, tenants will be granting the enigmatic and elusive developer a lot more credence now development is finally moving. So will many others.

Perhaps the wait for the redevelopment of Albert Dock is finally over.

Plans for the site

- 3.5m sq ft of office space, across around 40 buildings

- 35 acres in total, with a £1.7bn build cost

- Phase one is to start imminently

- CITIC Construction is lead contractor, Multiplex is sub-contractor

- Development finance provided by five Chinese banks: CITIC Bank, Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China and China Construction Bank Corporation

- Equity provided by CITIC, Charoen Pokphand Group and Strawberry Star

- Stanhope is acting as development manager

Exciting times for the Royal Docks

Neil Robinson, director of global communications, ABP

High rents and a shortage of office space in central London and the West End are likely to see the race to east London gathering pace in the commercial sector. In addition, forecasts show London’s population will increase by 16% in the next few years, accelerating the demand for development in the east of the city. Within this framework exciting times lie ahead for the Royal Docks. Mayor of London Sadiq Khan has pulled together a task force to energise the redevelopment of the final parts of the Royal Docks jigsaw and more than £380m of investment is promised to be spent on infrastructure, employment programmes and cultural activities in the area in the next few years.

Construction work has begun at Royal Albert Dock on London’s third business district – after the City and Canary Wharf. The £1.7bn ABP Royal Albert Dock project is a mixed-use development comprising more than 70% office buildings with supporting residential and retail across the 35-acre site. Many of the office buildings range in size from 17,000 sq ft to 28,000 sq ft – a rare find, particularly in this part of London, and giving an opportunity for medium-sized companies to occupy an entire building. The first phase will be ready by early 2019.

Regeneration

London’s love of revitalising its old docks is well charted and a brilliant example of first-class urban regeneration.

When the St Katharine Docks redevelopment began in the 1970s there was some scepticism. It is hard to imagine now that plans to nudge classy London eastwards along the river was considered by some to be a risky endeavour, as Tower Bridge was thought back then to be too far from town. But London’s roll-out continued apace, with Limehouse reshaped into a fashionable hang-out, boasting a Gordon Ramsey gastropub as well as the famous Grapes – once frequented by Charles Dickens and now under the stewardship of actor Sir Ian McKellen.

But it was the development of Canary Wharf that helped to transform the fortunes of London and underlined the strategy that London should expand eastwards. Despite the fact that its early days were troubled by uncertainty in the commercial property market, it has flourished and today is the hub for North American banking giants and connected financial services companies. The investors back in the early 1990s must wish they had kept faith with the project and recognised that Docklands represented a continuing success story.

Now, all the factors are in place to see the Royal Docks become one of the hottest destinations in the capital.

The area already has its own airport – London City Airport has direct flights to more than 40 business cities across Europe, as well as daily flights to New York via Shannon in Ireland, and work is set to get under way on an expansion programme that will see it adding Dubai, Moscow and Mumbai to its regular schedule. Add to that the tens of thousands of visitors travelling from across the globe every year to attend the wide spectrum of high-profile events at the ExCel International Exhibition Centre and the Royal Docks can confidently declare itself one of the capital’s most international locations. Crossrail opens here in 2018, slashing journey times across London. And there are already 11 DLR stations running through the Royals, a good road network linking to the M11 – making Cambridge achievable in under an hour – plus the only cable car service spanning the Thames, linking Royal Victoria Dock to the 02 arena.

Pipeline

The Royal Docks has the feel of a mature destination. However there are new and exciting developments to come. New apartment buildings are rising in Royal Victoria and a further 3,500 homes are in the pipeline at Silvertown.

Hindsight is a wonderful thing. Looking back over the past 30 years, the success of London’s Docklands is obvious.

Foresight is a gift. Investors with an eye to the future may look at the Royal Docks and recognise that it has potential that will be realised.