When is a building classed as ‘under construction’? Blake Penfold and Roger Cohen breathe a sigh of relief following the Supreme Court’s much-anticipated decision in Monk

A building that was once rateable is stripped out and vacant. Its owner has embarked on redevelopment. So when are business rates payable for that building?

Since 13 February 2015, the answer had been controversial.

But 1 March 2017 brought good news for owners in England and Wales when the Supreme Court allowed an appeal in SJ & J Monk (a firm) v Newbigin (VO) [2017] UKSC 14; [2017] PLSCS 52.

Background to the case

The case concerned the first floor of an office building. The property had been occupied, but the tenants vacated and surrendered the lease. The owner, SJ & J Monk, entered into a contract to refurbish that floor, making it suitable to let as up to three separate suites.

Contractors removed ceiling tiles, the suspended ceiling grid, light fittings and about half the raised floors. They had also removed the cooling system and sanitary fittings, demolished the block walls of the lavatories, and stripped out the electrical wiring. Plasterboard partitions were erected and plastered to form the outline for the new WCs and a partition erected and plastered across one side of the floor. First fix electrical installations to the WC area had been completed and alterations made to the drainage.

At this point, the owner made a proposal to alter the rating list entry by changing the description from “offices and premises” to “building undergoing reconstruction” and to reduce the assessment from rateable value (RV) £102,000 to RV £1. Was the owner’s proposal well made?

Some ground rules

The answer brought into conflict two ground rules of rating. First, one values what one finds in reality on the day that is relevant to the enquiry: “the reality principle”. Secondly, Schedule 6 to the Local Government Finance Act 1988 says that the rateable value of a property assumes that the property is in a reasonable state of repair (see box A).

Box A

The rateable value of a non-domestic hereditament… shall be taken to be an amount equal to the rent at which it is estimated the hereditament might reasonably be expected to let from year to year on these three assumptions –

(a) …

(b) the second assumption is that immediately before the tenancy begins the hereditament is in a state of reasonable repair, but excluding from this assumption any repairs which a reasonable landlord would consider uneconomic;

(c) …

Monk was not a case where the repairs would have been uneconomic. The issue that emerged was, do you value in accordance with the reality principle (so the property is a building site); or, do you assume that the property is back in repair as the statute seems to assume?

The appeal history

The owner’s proposal was not agreed by the valuation officer (VO) and was referred to the Valuation Tribunal for England (VTE). The VTE dismissed the owner’s appeal. The owner appealed to the Upper Tribunal (Lands Chamber), which allowed the appeal on the basis that the premises had been stripped out to such an extent that replacing the missing items went beyond the meaning of repair. The Upper Tribunal altered the description to “building undergoing reconstruction” and reduced the assessment to RV £1.

The VO appealed to the Court of Appeal, which held that the property had to be valued in an assumed “reasonable state of repair” despite the works that were going on. It asked:

1. Is the property in a worse condition than it once was? If so, it is in disrepair.

2. Are the works that would be required to make it capable of beneficial occupation for its earlier use works of repair?

The Court of Appeal said that, if both answers were “yes”, then the property had to be valued in an assumed reasonable state of repair for its former use, regardless of its actual condition.

Intervention

It was obvious to rating surveyors who had followed the case thus far, that something had gone awry. The Court of Appeal ([2015] EWCA Civ 78; [2015] EGLR 28) had even criticised the Valuation Office Rating Manual for being too generous. But what to do? Happily, SJ & J Monk applied for permission to appeal to the Supreme Court. The ratepayer was granted leave to appeal and both the Rating Surveyors’ Association and the British Property Federation were given permission to intervene.

The Supreme Court judgment

In a unanimous judgment, the Supreme Court determined that the works of alteration could not be ignored. The assessment should be reduced to a nominal figure during those works. The property was not capable of beneficial occupation, for any purpose, during the works and it was therefore correct that the value should reflect this.

The court’s conclusion was that a building has a physical state but it also has a mode or category of occupation, for example “offices and premises” or “building under reconstruction”. The statutory assumption of repair applies to the former. The reality principle applies to the latter (see box B). But you have to assess objectively the mode or category of occupation in order to understand what physical specification results.

Box b

|

Reality principle |

Statutory assumption |

|

|

Physical state |

no |

yes |

|

Mode or category of occupation |

yes |

no |

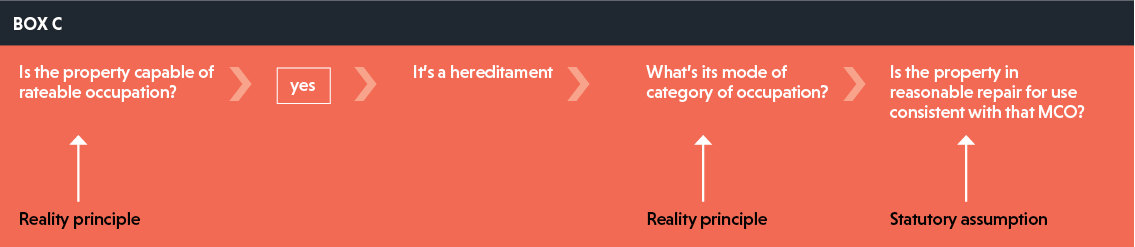

In allowing the ratepayer’s appeal, the Supreme Court approved the “helpful” approach advocated by the interveners. This starts by asking if the property is capable of beneficial occupation and if so, assessing its mode or category of occupation, leading to a building assumed to be in reasonable repair for that occupation (see box C). Developers will be pleased to see the recognition that a building undergoing redevelopment will be incapable of beneficial occupation (see box D).

Box D

“…a building under redevelopment, like a building under construction, is incapable of beneficial occupation and, in any event, the hypothetical landlord of a building undergoing redevelopment would normally not consider it economic to restore it to its prior use.” Lord Hodge, para 23

Box F

“There is no bar to implementing a proposal to alter the description of the hereditament on the rating list from offices and premises to building undergoing reconstruction and consequently to reduce the list rateable value to a nominal amount if the facts, objectively assessed, support that alteration.” Lord Hodge, para 31

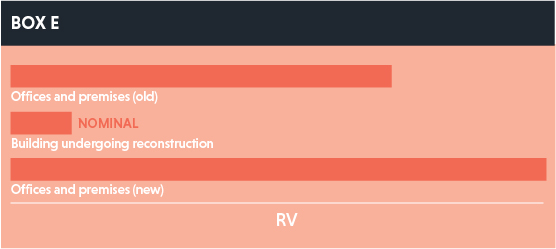

Before the Court of Appeal judgment, it was common practice to deal with a property being redeveloped by reducing the rateable value to a nominal figure during the works (see box E). That approach now has the blessing of the Supreme Court (see box F).

The court’s judgment supports the previous VOA guidance, which took account of an owner’s works to change the use or occupation of a property. The court considered concerns about potential for empty rates avoidance by owners commencing works, but not completing them, and commented that the Rating (Empty Properties) Act 2007, which introduced 100% empty rate liability, allowed the secretary of state to introduce anti-avoidance measures. To date, these powers have not been deployed.

Consequences of the decision

This decision clarifies the role of the assumption of a “reasonable state of repair” when valuing for rating purposes. It confirms that application of a nominal value in circumstances where substantial works are going on is correct. Equally, it acknowledges that a property incapable of beneficial occupation by virtue of works should not be rated as if beneficial occupation was an option.

If the property is capable of beneficial occupation, then it can be a hereditament and it will be necessary to determine the mode or category of occupation, and whether the property is in a reasonable state of repair for use for that mode or category of occupation.

Only the question of whether the property is in a reasonable state of repair for that purpose, requires the assumption of a reasonable state of repair set out in paragraph 2(1)(b) of Schedule 6 to the Local Government Finance Act 1988. That assumption will be subject to the economic tests considered by the Upper Tribunal in Barber (VO) v CEREP III TW SARL [2015] UKUT 521 (LC); [2015] PLSCS 288 and other cases.

Next steps

For ratepayers, the next steps are obvious. There are several thousand rating appeals concerning properties undergoing works that have been stayed at various stages of the appeal process, pending the outcome of this case. Many, if not most, of these should now be capable of being resolved relatively swiftly in the light of this decision.

Ratepayers whose properties have been assessed only on the basis of the Court of Appeal’s ruling are entitled to have their money back. This means that valuation officers must examine the proposals and appeals that are on hold and the VTE will have to start listing for hearing appeals which had been stayed pending the Supreme Court outcome. VOs could save themselves, ratepayers, and the VTE a lot of time and trouble by making the alterations to the list that are necessary to restore the pre-Court of Appeal status quo. The VTE should afford all reasonable assistance to ratepayers in giving hearing dates in those appeals that cannot be swiftly agreed.

For the VOA, there may be a temptation to a slower, considered reaction. That temptation should be resisted. Ratepayers will remember that following the Court of Appeal ruling, the Rating Manual was amended to reflect the decision. The VOA should make the revisions that are now required, also without delay.

It remains to be seen whether the government will now seek to activate the anti-avoidance measures.

If there was no pressing need up to February 2015, there should be no pressing need now.

The outcome will please property owners and developers, especially those active in metropolitan areas where achievable rents never make repair uneconomic. Schemes rendered unviable by the Court of Appeal can now proceed. This is a boost for the built environment. For that, many will be grateful.

Blake Penfold is a business rates consultant at http://blakepenfold.com/ and with GL Hearn. Roger Cohen is a real estate sector partner at Berwin Leighton Paisner LLP and acted for the interveners in Monk